What are the 5 major benefits of Financial Literacy?

What are the 5 major benefits of Financial Literacy?

Financial literacy refers to the knowledge and understanding of various financial concepts and skills which one can use in taking effective financial decisions. This skill can be utilized in managing personal finance, taking personal financial decisions, creating a budget, planning for higher education, managing their debt, saving for a future business venture, ensuring security after retirement or for fulfilling one’s dream of the life.

Usually, we talk about long term financial strategies when it comes to financial literacy but it takes into account short term financial strategies also. There are several factors responsible behind the choice of these strategies like the age, the time horizon, the income level, the risk bearing capacity and the existing financial cushion. It is just about knowing the impact of today’s financial decision on their tomorrow’s financial wellbeing. Financial Literacy can be obtained through reading books, listening to podcasts, following financial experts, subscribing to financial contents, etc.

In the era of cut throat competition where everyone is in the race of standing on top, it is quite essential to possess proficiency in understanding the components like compound interest, time value of money, mortgages, student loans, health insurance and different other investment avenues. Lacking financial literacy can be very dangerous for the long-term financial health and success. Being financially illiterate can lead to a number of difficulties like poor credit score, unnecessary debt burden, faulty spending patterns, housing foreclosures, huge losses and bankruptcy. One can save themselves from such future financial mishaps just by having basic financial literacy.

So, The 5 Major Benefits of Financial Literacy are listed below:

- Prevention against Financial Frauds:

Familiarity with the maximum investment options enables one to detect the frauds at an early stage. Financial literacy helps to know the possible pros and cons associated with each option thereby preventing them against any probable financial frauds. - Attainment of Financial goals:By better understanding how to plan, how to save and how to budget builds a financial discipline and enables them to achieve their life goals which otherwise seemed unattainable. If someone’s dream cannot be fulfilled today, it can definitely be fulfilled in future with proper financial planning and accountable financial actions.

- Security against financial emergencies:Future is always uncertain and loosing a job or any unexpected expense will always affect the financial wellbeing but with the application of financial literacy one can create a financial backing which can serve as a cushion for financial shocks and secures them against financial emergencies.

- Prevention against devastating mistakes:Different investment avenues have different investment criteria, different risk and return factors, different withdrawal and transfer options. Thorough knowledge of these equips them in choosing correct option to invest in accordance to their long-term financial needs.

- Upliftment of confidence:Being armed with the appropriate financial knowledge one can make confident life choices because of the realization that they are less likely to encounter any shocks or surprises.

Name: Ms. Puja Kumari

Designation: Assistant Professor

Department: Department of Commerce,

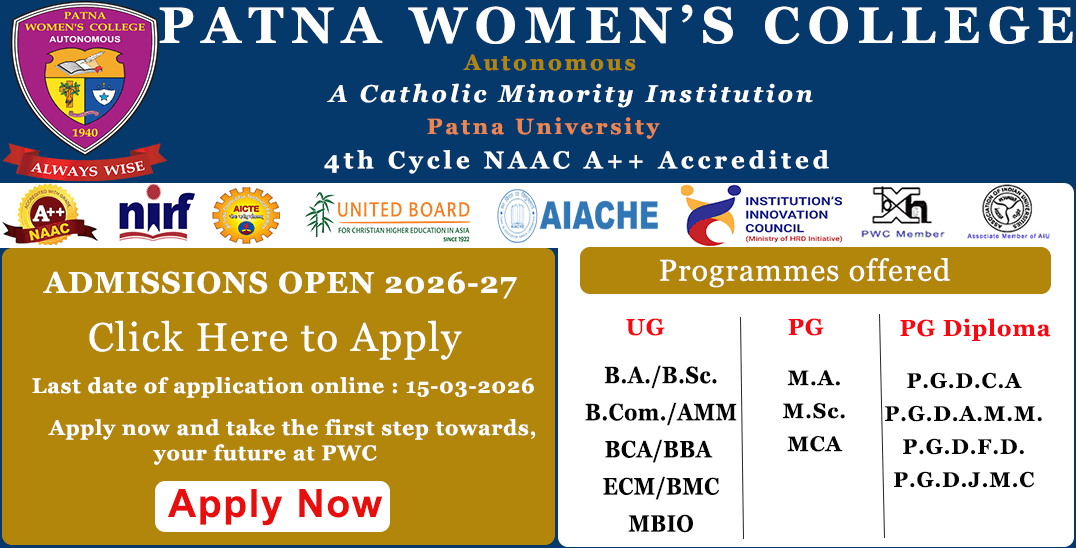

PWC

E-mail: puja.com@patnawomenscollege.in